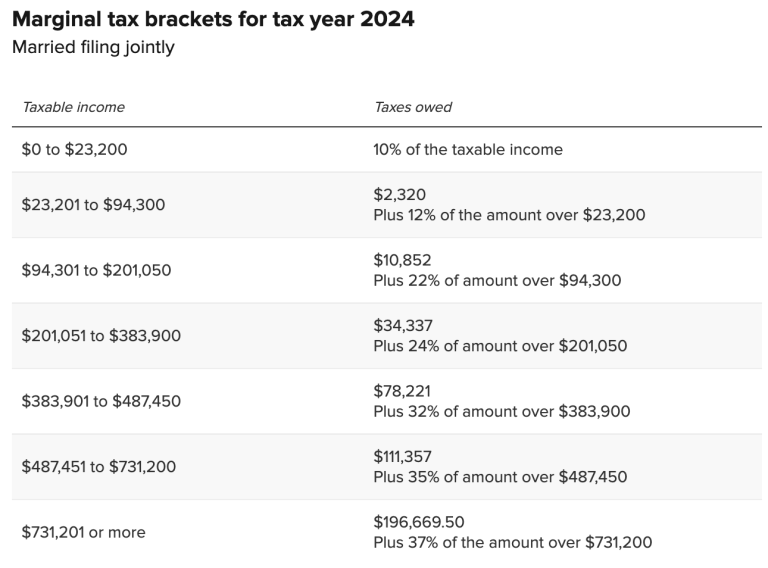

2025 Income Tax Brackets Mfj Limit. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). Single taxpayers 2025 official tax.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. Understanding how your income falls into different tax brackets can help with tax.

The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

2025 Tax Brackets Mfj Limits Brook Collete, These are not the tax rates and other numbers for 2025 (you'll find the official. Among the provisions that could expire are the.

Mfj Tax Brackets 2025 Irs Edita Gwenora, You file a joint return, and you and your spouse have a combined. The social security tax limit increases to $168,600 in 2025, up from $160,200 in 2025, which could result in a higher tax bill for some taxpayers.

2025 Tax Brackets And Deductions Cody Mercie, The highest earners fall into the 37% range, while those who earn the least are. These are not the tax rates and other numbers for 2025 (you'll find the official.

2025 Tax Brackets Mfj Kanya Zitella, These are not the tax rates and other numbers for 2025 (you'll find the official. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1%.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, We've got all the 2025 and 2025. Here's how those break out by filing status:

2025 Tax Brackets And The New Ideal Financial Samurai, Single taxpayers 2025 official tax. The tax cuts and jobs act of 2017 is expected to sunset in 2025 which could usher in several tax changes.

IRS announces new tax brackets for 2025, You file a joint return, and you and your spouse have a combined. You pay tax as a percentage of your income in layers called tax brackets.

Tax Brackets 2025 Single Nelia, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Understanding how your income falls into different tax brackets can help with tax.

IRS Announces New Tax Brackets for 2025, You file a joint return, and you and your spouse have a combined. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the.

Tax Brackets 2025 Vs 2025 Pavla Leanor, See current federal tax brackets and rates based on your income and filing status. Oct 31, 2025 · authored by michelle hobbs, paul dillon.

2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1%.